Pyramid schemes, akin to Ponzi schemes, often present themselves as alluring opportunities, luring unsuspecting investors into insidious traps with unsolicited offers and promises of high returns.

It is essential to grasp the key characteristics that distinguish these schemes from legitimate multi-level marketing (MLM) ventures to effectively protect one’s finances.

Investors should be adept at recognizing red flags such as unrealistic promises, recruitment pressures, and unclear commission structures, often highlighted by pushy salespersons and guaranteed returns.

Equipped with real-life examples and practical strategies, including conducting proper research and seeking financial advice, individuals will be better prepared to navigate the murky waters of investment opportunities.

Key Takeaways:

What is a Pyramid Scheme?

A pyramid scheme is an investment fraud model that lures individuals with the promise of high returns, primarily relying on the recruitment of additional members rather than the sale of tangible goods or services.

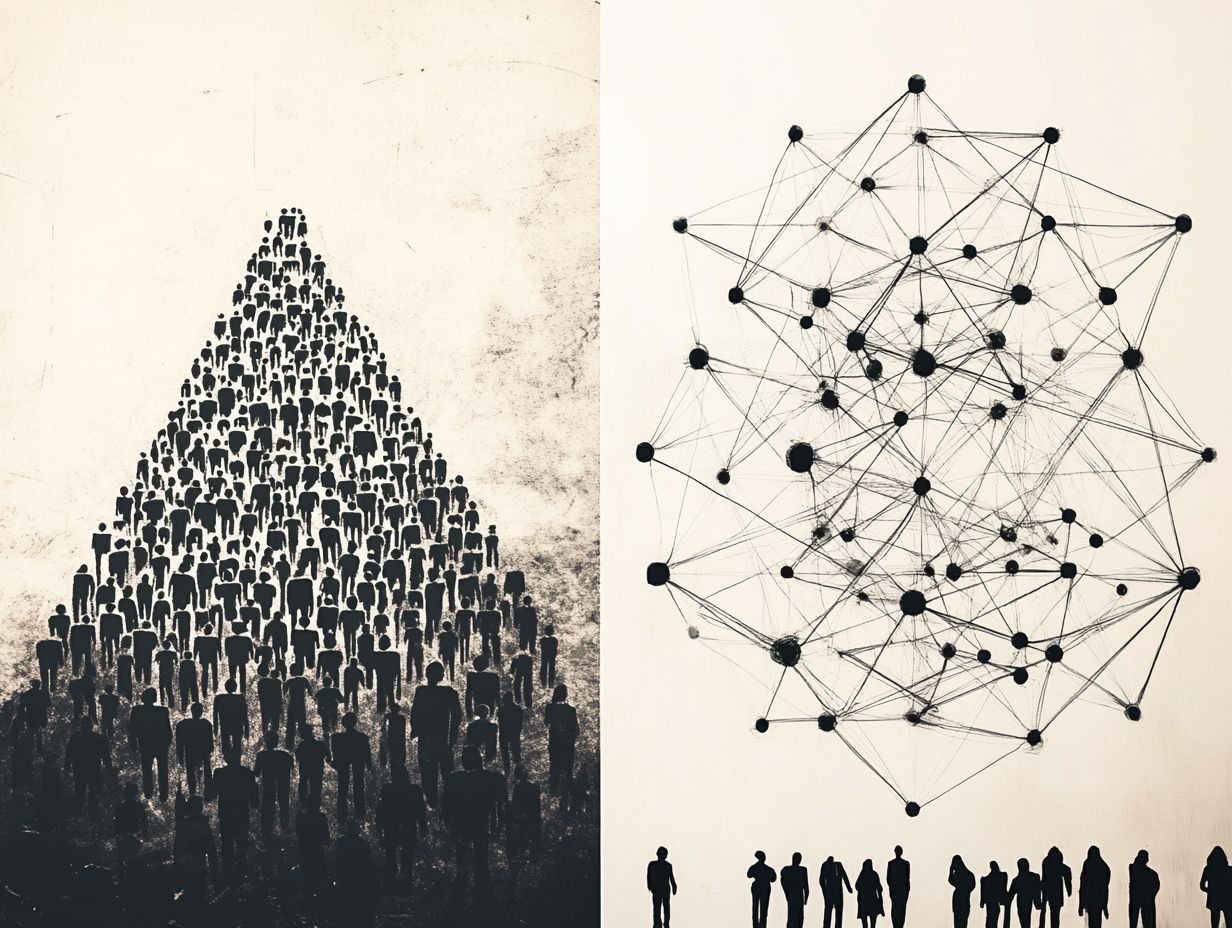

At its core, new recruits are captivated by the prospect of quick profits, hinging their hopes on the investments made by those who follow them. This structure thrives only as long as new members are continuously introduced at escalating levels. However, this model is inherently unsustainable, leading to an eventual collapse that leaves many participants empty-handed.

In stark contrast to legitimate business models, where profitability emerges from genuine transactions and value creation, pyramid schemes flourish on the façade of profitability, often shrouding their precarious nature in flashy presentations and embellished success narratives. Ultimately, the majority of participants find themselves at a loss, highlighting the deceptive tactics employed within such schemes.

How Pyramid Schemes Operate

Pyramid schemes operate through intricate and complex strategies that prioritize recruitment over genuine sales, often employing pressure tactics and imposing substantial recruitment fees on participants to gain entry.

These schemes are structured in a manner that necessitates each participant to recruit new individuals to maintain payouts, resulting in a model that ultimately hinges on a continuous influx of new recruits. The seductive promise of rapid profits and financial gain is frequently magnified through psychological tactics, such as instilling a sense of urgency or exclusivity, which effectively binds participants to the scheme.

The financial repercussions can be severe, as the majority of individuals find themselves at the base of the pyramid, suffering losses on their initial investments, while only a select few at the apex reap significant rewards.

Legality of Pyramid Schemes

The legality of pyramid schemes poses a significant concern, as these operations are deemed illegal under various financial regulations enforced by organizations such as the SEC and FINRA, which are dedicated to protecting consumers from investment fraud and ensuring consumer protection through accountability.

Both regulatory bodies actively strive to identify and dismantle these fraudulent enterprises, ensuring that unsuspecting individuals are shielded from financial harm. Beyond enforcement actions, they also offer educational resources designed to help the public recognize the distinguishing characteristics of pyramid schemes, which often present themselves as legitimate business opportunities.

By highlighting the risks associated with such schemes, these organizations play an essential role in consumer protection. Participants in these illicit setups may face severe legal ramifications, including substantial fines and the prospect of imprisonment, emphasizing the critical importance of accountability in upholding market integrity.

High Promises of Returns

High promises of returns, often touted in cold calls or unsolicited offers, frequently characterize pyramid schemes, luring investors with the tantalizing prospect of substantial profits that are seldom supported by legitimate business practices or internal controls.

These schemes often craft an enticing narrative of unimaginable wealth, preying on individuals’ aspirations for swift financial success. Such captivating offers can easily divert potential investors from the fundamental principles of sound investing, which rely on thorough research and stability.

Statistics reveal that roughly 95% of participants in pyramid schemes ultimately lose their money, starkly illustrating the disillusionment concealed behind these seemingly lucrative facades. Case studies, such as the notorious Ponzi scheme orchestrated by Bernie Madoff, underscore how effortlessly individuals can become ensnared in these traps, filled with unfounded optimism and misleading claims.

Consequently, the risks associated with these deceptive propositions not only jeopardize personal finances but also undermine trust in genuine investment opportunities.

Requirements to Recruit Others

In pyramid schemes, one of the fundamental requirements is the active engagement of members in recruiting others, often coupled with the payment of recruitment fees that contribute to the structure’s inherent unsustainability.

This recruitment process establishes a relentless cycle of dependency among participants, where the allure of financial gain is heavily predicated on the continuous influx of new members rather than the provision of any legitimate product or service. As individuals invest their time and money into these schemes, they find themselves increasingly entangled, often harboring the belief that they can recover their investments through further recruitment. This dependence only deepens their commitment, leading them to engage in risky investment choices that they might otherwise eschew.

The implications of such structures are profoundly unsettling, underscoring not only the potential for significant financial losses but also the emotional turmoil experienced by those ensnared in the pursuit of success within a fundamentally flawed system.

Complex Commission Structures

Pyramid schemes frequently utilize convoluted commission structures that obscure their true nature, leaving participants bewildered and fostering a misleading sense of financial security.

These structures generally reward individuals based on their ability to recruit new members rather than on the legitimate sale of products or services—a critical distinction that many fail to recognize. As new recruits continually join the bottom tier, the illusion of profitability expands, enticing current participants to invest even more.

This deceptive approach can have significant financial ramifications, as only a small fraction of those at the top genuinely reap the rewards, while the majority find themselves financially devastated.

The intricate payout mechanisms serve to mask any losses, making it increasingly difficult for participants to grasp the inherent unsustainability of such schemes.

Pressure to Buy Inventory

Participants in pyramid schemes often find themselves subjected to relentless pressure tactics aimed at persuading them to purchase inventory, ultimately exacerbating their financial investments and leading to significant losses.

These tactics typically create an artificial sense of urgency, compelling individuals to believe that acquiring additional inventory is the sole path to securing their position within the hierarchy and maximizing their potential returns. This strategy can render participants feeling ensnared, as they grapple with their aspirations for financial rewards against the daunting prospect of lagging behind their peers.

Recognizing the ramifications of this pressure is vital, as it not only impacts their immediate financial landscape but also heightens the risk of incurring long-term debt.

Maintaining awareness of manipulative tactics such as groupthink, emotional appeals, and misleading promises of substantial earnings is essential, as these can obscure the true nature of such schemes.

Lack of Transparency

A significant red flag in pyramid schemes is the glaring absence of transparency, often demonstrated by missing documentation and a failure to provide a comprehensive prospectus detailing the business model. Without clear and accessible information, potential investors find themselves in a murky landscape, struggling to evaluate the legitimacy of the opportunity.

In stark contrast, legitimate investments are accompanied by thorough documentation, including financial statements and regulatory compliance reports, ensuring that stakeholders are fully informed about the risks and rewards involved. Pyramid schemes, however, tend to obscure critical details, such as the actual flow of funds or participant earnings, ultimately undermining trust.

This lack of accountability can lead to devastating financial losses, as individuals become ensnared in a relentless cycle of recruitment rather than experiencing tangible profits. This reality underscores the vital importance of transparency in any investment strategy.

Conducting Proper Research

Conducting thorough research is a fundamental step in safeguarding against pyramid schemes, as it enables investors to grasp the intricacies of financial systems and critically assess potential investment opportunities. This diligence not only aids in uncovering the legitimacy of various options but also fosters confidence in the decision-making process. Furthermore, staying vigilant for unsolicited offers and unregistered investments can prevent financial losses.

Investors should begin by analyzing business models to ensure they are built on solid foundations with clear revenue streams, steering clear of offerings that seem overly complex or ambiguous. Scrutinizing financial reports is imperative; these documents must be transparent and provide detailed insights into income, profits, and expenditures. It is advisable for investors to compare metrics across similar organizations, on the lookout for red flags such as promises of unusually high returns with minimal risk, missing documentation, and complex strategies.

By actively seeking credible sources and tapping into expert evaluations, individuals can significantly enhance their understanding and avoid doubtful ventures. Being wary of pushy salesperson tactics and pressure tactics can also safeguard against Ponzi schemes and other fraudulent activities.

Investing with Trusted Partners

Investing with trusted partners, such as accredited investment brokers and reputable financial advisors, is crucial for minimizing the risks associated with pyramid schemes, cryptocurrency scams, and other fraudulent investments.

The selection process requires meticulous consideration of several factors, including regulatory compliance, proven track records, and transparent communication styles. A professional who demonstrates a strong commitment to ethical investing practices should prioritize the client’s interests above personal gain. Consumer vigilance is fundamental; potential investors ought to actively seek out reviews, request credentials, and verify affiliations with esteemed financial organizations. Being mindful of recruitment fees and exclusive offers that seem too good to be true is also crucial.

Understanding the nuances of ethical investments can significantly enhance one’s financial portfolio while contributing positively to sustainable development. Trustworthy partnerships not only instill a sense of security but also lay the groundwork for well-informed investment decisions and guaranteed returns.

Seeking Professional Financial Advice

Seeking professional financial advice offers invaluable insights for investors, guiding them through the complexities of investment risks while fostering a sense of accountability in their financial decisions.

By leveraging the expertise of financial advisors, individuals can access tailored strategies for effective portfolio management, retirement planning, and wealth accumulation. These seasoned professionals have the ability to demystify various investment options—such as stocks, bonds, and mutual funds—enabling clients to make informed and confident choices. Considering alternative investments and studying market conditions can further enrich an investor’s portfolio.

Their guidance proves pivotal in steering clients away from high-risk ventures, including pyramid schemes that often promise substantial returns with minimal transparency. By identifying red flags and emphasizing the significance of due diligence, financial advisors give the power to investors to safeguard their assets and promote long-term financial well-being.

In Summary: Spotting Pyramid Schemes

Identifying pyramid schemes requires an astute awareness of several red flags, such as exaggerated promises of returns, pressure tactics, and a glaring absence of transparency within the business model.

For potential investors, it is essential to remain informed and educated about the warning signs that may signal fraudulent activities. A critical strategy involves conducting meticulous research on any investment opportunity, verifying both the legitimacy of the company and the credibility of its leadership.

Consumers should exercise caution towards any business that prioritizes recruitment over product sales, as this often indicates a potential scheme. Establishing a network of knowledgeable acquaintances or seeking insights from professionals can significantly enhance awareness and aid in the early detection of dubious operations. Staying alert to cold calls and being skeptical of insider information can also serve as protective measures.

By fostering vigilance and committing to continuous education, individuals can effectively protect their investments from such deceitful practices.

Resources for Further Learning

For investors seeking to enhance their understanding, resources focused on investor education, financial advice, and consumer protection offer invaluable insights into the prevention of pyramid schemes.

These tools not only equip individuals with a thorough comprehension of potential risks but also steer them toward prudent investment strategies and portfolio diversification. Esteemed organizations such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) provide a rich array of educational materials specifically designed for investors.

Websites like Investopedia and seminal works such as ‘The Intelligent Investor’ by Benjamin Graham stand as excellent references for fundamental financial principles. By looking into these resources, an investor remains informed and vigilant, ensuring proactive measures against potential scams while making astute decisions. Additionally, learning about various investment vehicles and the roles of organizations like the Barbados Stock Exchange can broaden one’s financial literacy.

Frequently Asked Questions

1. What is a pyramid scheme and how can I spot one?

A pyramid scheme is a fraudulent investment scheme where investors earn money primarily by recruiting new members instead of selling a legitimate product or service. One of the biggest red flags is when the emphasis is placed on recruiting and not on selling a product.

2. What are some common red flags that can help me identify a pyramid scheme?

One major red flag is the promise of high returns with little to no effort or risk. Other warning signs include a lack of legitimate products or services being sold, a complex commission structure, and pressure to recruit new members. Be cautious of cryptocurrency scams and investment opportunities that come with missing documentation.

One major red flag is the promise of high returns with little to no effort or risk. Other warning signs include a lack of legitimate products or services being sold, a complex commission structure, and pressure to recruit new members.

3. Can you provide some real-life examples of pyramid schemes?

One well-known example is the case of Bernie Madoff, who ran a Ponzi scheme and defrauded thousands of investors out of billions of dollars. Other examples include the Herbalife and Amway MLMs, which have been accused of operating as pyramid schemes. Another instance is the recent collapse of FTX, which has been linked to fraudulent practices.

One well-known example is the case of Bernie Madoff, who ran a Ponzi scheme and defrauded thousands of investors out of billions of dollars. Other examples include the Herbalife and Amway MLMs, which have been accused of operating as pyramid schemes.

4. Are all MLMs considered pyramid schemes?

No, not all MLMs are pyramid schemes. While they may have a similar business structure, legitimate MLMs focus on selling a product or service and do not rely solely on recruiting new members. It’s important to do thorough research and be wary of any MLM that prioritizes recruitment.

5. Can I make money in a pyramid scheme?

While it’s possible to make money in a pyramid scheme, it’s not sustainable and usually requires recruiting large numbers of people. Eventually, the scheme will collapse and the majority of investors will lose their money. It’s always best to avoid pyramid schemes altogether. Consider exploring ethical investing and more legitimate investment strategies for sustainable returns.

While it’s possible to make money in a pyramid scheme, it’s not sustainable and usually requires recruiting large numbers of people. Eventually, the scheme will collapse and the majority of investors will lose their money. It’s always best to avoid pyramid schemes altogether.

6. What should I do if I suspect I’m involved in a pyramid scheme?

If you have concerns about the legitimacy of an investment opportunity, it’s important to do your research and consult with a financial advisor. You can also report suspected pyramid schemes to the Federal Trade Commission (FTC) or your state’s Attorney General’s office. Remember, if it seems too good to be true, it probably is. Staying informed about market volatility and continually seeking financial advice can help you navigate through potential investment pitfalls.

If you have concerns about the legitimacy of an investment opportunity, it’s important to do your research and consult with a financial advisor. You can also report suspected pyramid schemes to the Federal Trade Commission (FTC) or your state’s Attorney General’s office. Remember, if it seems too good to be true, it probably is.