Pyramid schemes often present an alluring facade, promising rapid wealth accumulation, yet the scams’ legal consequences of participating in one in 2024 can be quite severe, with potential financial loss larger than anticipated.

Grasping the intricacies and mechanics of these schemes is crucial for personal protection. This article meticulously explores the complex legal landscape surrounding illegal pyramid schemes, elucidating federal and state laws, potential criminal charges, and civil penalties faced by participants paying to join.

It also offers practical guidance on recognizing red flags and safeguarding oneself. Staying informed is essential for making prudent decisions throughout one’s financial journey.

Key Takeaways:

Understanding Pyramid Schemes

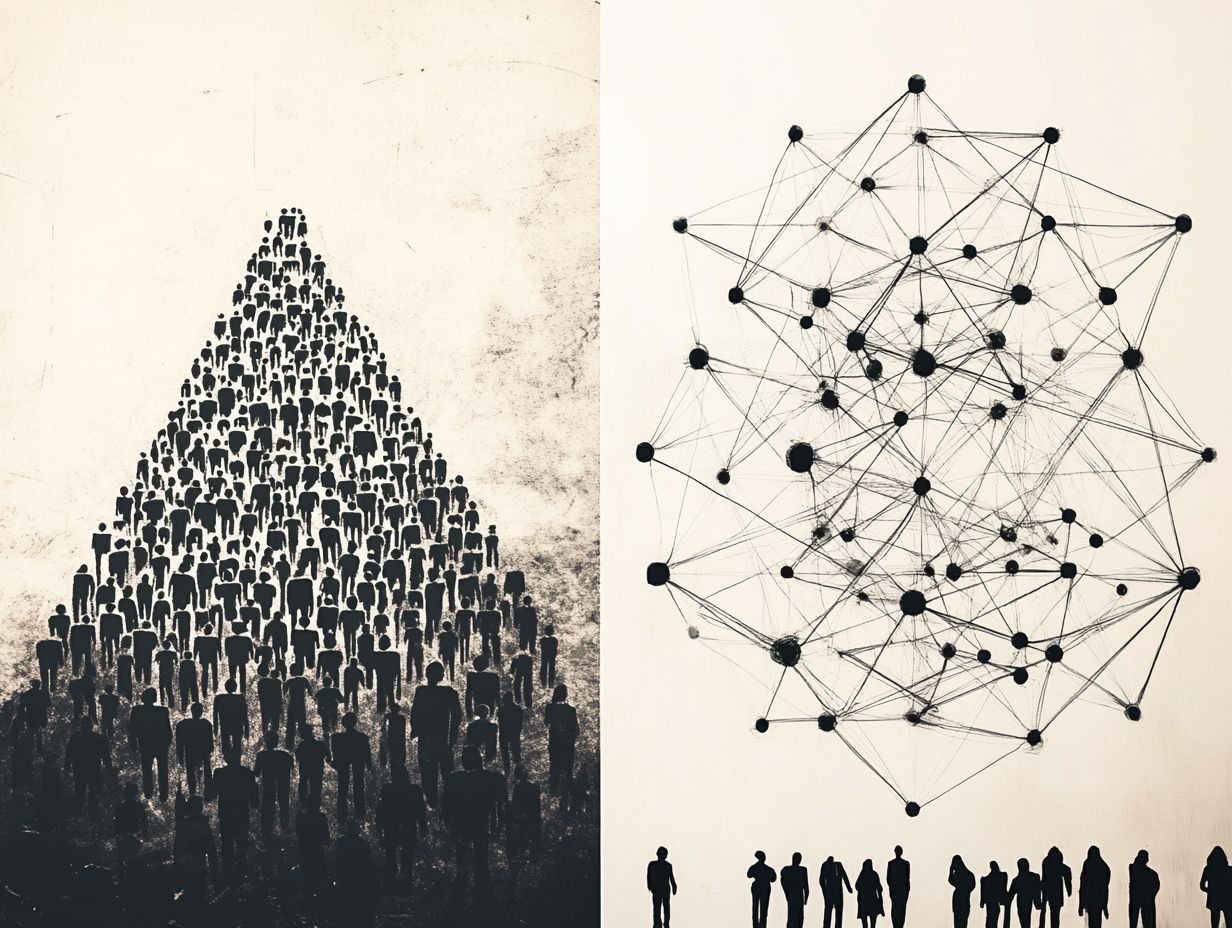

Understanding pyramid schemes requires an awareness of their insidious nature, characterized by a structure that resembles a pyramid. In these schemes, profit predominantly arises from the recruitment of new investors and new recruits, rather than the sale of legitimate products sold through a company marketing plan.

Participants frequently discover that the products offered are unsalable, resulting in substantial financial losses. The success of such schemes is heavily contingent upon the continuous influx of new recruits, underscoring the inherent risks and how success depends on the ability to recruit for those entangled within the system.

What Is a Pyramid Scheme?

A pyramid scheme represents an illegal business model that primarily reaps profits through the recruitment of investors rather than the sale of legitimate products or services. Such schemes often entice participants with promises of extraordinary returns and high returns for those who successfully bring in new recruits.

These pyramid schemes stand in stark contrast to multi-level marketing (MLM) structures, which may operate legally, provided they focus on genuine product sales. Regrettably, statistics reveal that a remarkable majority of individuals involved in pyramid schemes face significant financial setbacks and financial loss larger than expected, with reports indicating that up to 99% of investors fail to achieve profitability.

As each new recruit injects funds into the scheme, a temporary financial bubble emerges, dependent on a continual influx of new members to maintain its existence. Ultimately, this bubble is destined to burst, as noted in cases handled by Spodek Law Group, when recruitment begins to wane, leaving the final participants grappling with considerable losses and devoid of any recourse for recovery.

How Pyramid Schemes Work: The Mechanics

Pyramid schemes function by requiring participants to pay an entry fee, creating a hierarchical structure where they are incentivized to recruit others beneath them. This establishes a downline that channels profits upward, often resulting in a cycle where promoters are left with unsold products they cannot repurchase, and promoters refuse to repurchase from investors.

Such schemes craft a misleading narrative, luring individuals with promises of substantial returns for minimal effort. As newcomers enter the fold, the majority of the money circulates toward those at the top, while existing members feel an escalating pressure to recruit their own prospects to maintain their income streams and avoid financial turmoil.

Participants frequently find themselves ensnared in a web of psychological tactics, grappling with the fear of missing out and the enticing promise of rapid financial independence. This can lead to considerable emotional and financial turmoil, and for some, even result in a criminal history.

When contemplating an exit, individuals may encounter social backlash from their communities, exacerbated feelings of loss, and the stark reality of financial setbacks, making it profoundly challenging to extricate themselves from the seductive grasp of the scheme.

Legal Framework Surrounding Pyramid Schemes

The legal framework governing pyramid schemes encompasses a range of federal and state regulations aimed at safeguarding consumers from deceptive practices. This framework is articulated by the Federal Trade Commission and reinforced through state legislation, including the New York State General Business Law and the California Penal Code, with involvement of the Attorney General and Consumer Protection Division.

Federal Laws and Regulations

Federal laws and regulations, particularly those enforced by the Federal Trade Commission (FTC), are designed to combat illegal pyramid schemes by establishing clear guidelines for legitimate business practices and safeguarding consumers. The involvement of legal representation can also provide a critical defense for those accused.

The FTC assumes a crucial role in monitoring these schemes, actively pursuing enforcement actions against those who engage in deceptive practices. To effectively differentiate between lawful multi-level marketing and illicit pyramid schemes, it is vital to grasp the legal definitions and criteria set forth by federal regulations.

For instance, a legitimate multi-level marketing program prioritizes product sales, allowing participants to earn commissions primarily through the sale of goods or services, rather than merely recruiting new members, thus maintaining product quality and customer satisfaction.

Conversely, if a business model emphasizes recruitment over product sales, it likely strays into the territory of an illegal pyramid scheme, thereby placing itself under the scrutiny of the FTC and exposing itself to potential prosecution and charges such as wire fraud.

State Laws and Enforcement

State laws, such as those articulated in the New York State General Business Law and the California Penal Code, are pivotal in enforcing regulations against pyramid schemes. In this context, the involvement of the state Attorney General and the Consumer Protection Division is often paramount in addressing issues involving scams and legal consequences.

These regulations exhibit considerable variability across jurisdictions; some states impose stringent penalties, while others adopt a more lenient stance. In New York, for instance, promoters face severe civil penalties, and participants may also encounter repercussions if they are found to be engaging in the scheme, such as those seen in the cases of Julius Wanzeler and James Merrill.

Conversely, California has witnessed significant legal actions that underscore the state’s proactive approach, frequently culminating in lawsuits against companies and individuals implicated in deceptive practices, including those involved in illegal investment clubs and gift programs.

Such consequences serve as a salient reminder of the illegal nature of these schemes, highlighting the potential financial peril for unsuspecting participants who may inadvertently find themselves entangled in fraudulent operations.

Comparison of Pyramid Schemes vs. Legitimate Multi-Level Marketing

When comparing pyramid schemes to legitimate multi-level marketing, it is essential to recognize that although both may involve recruiting new participants and selling products, legitimate multi-level marketing hinges on actual product sales rather than primarily on recruitment.

This fundamental distinction is crucial for comprehending the operational dynamics of these models and the legal implications they carry. Pyramid schemes frequently lack any genuine product or service, instead focusing on luring new members to invest funds, thus creating an unsustainable cycle.

In stark contrast, successful multi-level marketing companies, such as Amway and Avon, prioritize tangible goods and services, ensuring that participants gain value from actual purchases, with a focus on product quality and minimizing financial loss larger than investments.

By enforcing rigorous controls and standards, these legitimate enterprises not only emphasize product quality but also cultivate customer satisfaction, fully aware that their reputation is contingent upon the effectiveness and appeal of the products they promote.

Legal Consequences for Participants

The legal repercussions for individuals involved in pyramid schemes can be considerable, encompassing criminal charges that may lead to imprisonment, as well as civil penalties and substantial fines. These consequences often culminate in significant financial distress for the participants, especially if they are part of a small group initial investors.

Criminal Charges and Potential Jail Time

Individuals caught up in pyramid schemes may find themselves facing criminal charges, which can result in significant jail time, contingent upon the extent of their involvement and the laws of their respective jurisdictions.

Charges may include wire fraud, a serious offense typically invoked when electronic communications play a role in the scheme. Additionally, conspiracy charges can be imposed if participants conspired or coordinated with others to facilitate the fraudulent operation, reflecting the potential for financial loss larger than expected.

High-profile cases, such as the notorious Ponzi scheme orchestrated by Bernie Madoff, serve as stark illustrations of not only the potential for lengthy prison sentences but also the substantial financial restitution owed to victims, highlighting the importance of understanding the company marketing plan and the legal representation needed.

While those positioned at the lower tiers of the scheme may encounter lesser penalties, the ever-present threat of federal prosecution looms large for everyone entangled in such activities, with the risk of financial loss larger than anticipated for investors and distributors alike.

Civil Penalties and Fines for Participants

Civil penalties and fines for individuals entangled in pyramid schemes can be substantial, serving as a formidable deterrent against participation in or promotion of these fraudulent activities, which often involve participants paying to join and investors recruiting new members. These financial repercussions aim not only to penalize those who seek to profit from such schemes but also to protect potential victims from exploitation.

The amount of fines is influenced by various factors, including the severity of the offense, the number of affected parties, and whether the offender has a history of similar infractions. For those caught in the crossfire, the long-term financial implications can be devastating; participants may grapple with crippling debt or significantly reduced income due to restitution payments, often exacerbated by investors losing money and unsalable products investors have to deal with.

The enforcement of these penalties typically falls under the purview of regulatory agencies, which can lead to further legal challenges, highlighting the scams legal consequences and issues that entities like the Federal Trade Commission often address., highlighting the serious risks associated with involvement in pyramid schemes.

Factors Influencing Legal Outcomes

Numerous factors play a crucial role in determining the legal outcomes for individuals entangled in pyramid schemes. These factors include the degree of involvement—whether one acts as an organizer or merely as a participant—and the precedents set by prior cases in similar contexts, such as those involving Julius Wanzeler and James Merrill.

Involvement Level: Organizer vs. Participant

The degree of involvement in a pyramid scheme significantly affects the legal repercussions encountered, with organizers typically facing harsher penalties than participants.

This variance stems from the perception that organizers are the masterminds behind the fraudulent enterprise, deeply entrenched in its design and implementation, often seen in New York State under laws like the General Business Law. A notable instance illustrated this principle: a scheme orchestrated by individuals who deceived numerous investors led to substantial fines and considerable prison sentences.

Conversely, lower-tier participants, while not blameless, often receive more lenient penalties due to their comparatively minor roles, frequently acting under the direction of those higher up the chain. This distinction underscores a vital element of legal accountability—where the extent of one’s involvement profoundly influences sentencing outcomes.

For instance, in a recent judgment, an organizer was handed a ten-year prison term, while many participants merely faced fines or probation, underscoring the stark disparity in consequences tied to the level of engagement.

Precedents from Previous Cases

Precedents set by previous court cases related to pyramid schemes are instrumental in determining the legal outcomes for both current participants and organizers. These rulings establish key benchmarks that significantly influence future litigation.

For instance, landmark cases such as *FTC v. Amway Corp.* have provided clarity regarding the distinction between lawful multi-level marketing practices and illegitimate pyramid schemes. This groundwork allows regulators and participants alike to evaluate their positions with greater precision.

These judicial decisions emphasize the necessity of transparency and truthful representation in marketing practices, affecting not only the current landscape for participants but also any forthcoming business models that may wish to implement a multi-tier sales structure.

As a result, these legal precedents play a pivotal role in the evolution of legislation, urging lawmakers to refine definitions and enhance consumer protections. The ultimate objective is to reduce the risk of exploitation within these frequently contentious business practices.

How to Protect Yourself

Safeguarding oneself from pyramid schemes requires a keen eye for identifying red flags and a proactive approach to steering clear of these deceptive ventures.

Engaging in such schemes can result in considerable legal and financial consequences, making vigilance and well-considered choices essential for protection against these fraudulent activities.

Identifying Red Flags of a Pyramid Scheme

Identifying the red flags of a pyramid scheme is crucial for potential investors, particularly those that emphasize recruitment over the sale of genuine products.

One should remain vigilant for unrealistic financial promises that appear too good to be true; if a program asserts that significant income can be generated with minimal effort, despite the hard work involved., it is likely a warning sign. Additionally, pressure to recruit new members may suggest that the business thrives on new recruits earning and profit stemming primarily from recruitment rather than sales. rather than delivering genuine value or quality products. A discerning individual would be wise to evaluate the quality of the products presented, as mediocre offerings or exaggerated claims often indicate the presence of a potential scam.

By recognizing these warning signs, investors can navigate the landscape more effectively, understanding how a structure resembles a pyramid. and avoid unnecessary pitfalls.

Steps to Take if You Suspect Involvement

If an individual suspects involvement in a pyramid scheme, taking immediate action is crucial to safeguarding against potential legal and financial repercussions.

First, it is essential for them to gather all relevant documents, including contracts, emails, and any promotional materials linked to the scheme, ensuring a comprehensive prospectus of their involvement. This information will prove invaluable for legal representation.

Next, they should consider consulting with an attorney who specializes in fraud or consumer protection to fully understand their options and rights. Such legal expertise can provide guidance through the complexities of the situation.

Reporting the scheme to authorities, such as the Federal Trade Commission (FTC), the Spodek Law Group, or local consumer protection agencies, serves not only to protect oneself but also to help prevent others from becoming victims of the same deception.

Additionally, documenting and sharing their experiences can significantly contribute to ongoing investigations.

Staying Informed and Making Informed Decisions

Staying informed and making prudent decisions is essential to sidestepping the pitfalls of pyramid schemes. Awareness of the legal ramifications can effectively dissuade individuals from engaging in these high-risk ventures.

Education serves a vital role in cultivating a critical mindset, allowing individuals to discern the red flags that are often indicative of such schemes. Consumers can tap into a wealth of resources to remain informed, including government websites that delineate specific laws and provide guidelines for identifying fraudulent activities.

Local community workshops and online forums offer valuable platforms for discussion and updates on evolving regulations. Subscribing to consumer protection newsletters can also prove to be an critical tool.

By actively pursuing information, individuals give the power to themselves to make safer choices, contributing to a more enlightened society and ultimately diminishing the prevalence of these deceptive practices.

The California Penal Code and other state laws offer guidelines for identifying pyramid schemes and the success depends on the ability of individuals to discern potential fraud.

Frequently Asked Questions

1. What are the potential legal consequences of joining a pyramid scheme in 2024?

Joining a pyramid scheme in 2024 could result in severe legal penalties, including fines, jail time, and financial repercussions.

2. Can I face criminal charges for participating in a pyramid scheme?

Yes, participating in a pyramid scheme is considered a criminal offense and can result in fines and jail time.

3. What are the financial repercussions of joining a pyramid scheme?

Joining a pyramid scheme can have serious financial consequences, as participants may lose a significant amount of money and may even face bankruptcy.

4. Are there any laws specifically targeting pyramid schemes in 2024?

Yes, there are laws in place specifically targeting pyramid schemes, such as the Anti-Pyramid Promotional Schemes Act, which makes it illegal to participate in or promote pyramid schemes.

5. Can I be held liable for promoting a pyramid scheme in 2024?

Yes, promoting a pyramid scheme is a serious offense and can result in legal consequences, including fines and jail time.

6. What should I do if I suspect I am involved in a pyramid scheme?

If you suspect that you are involved in a pyramid scheme, it is important to stop participating immediately and consult with a legal professional to understand your rights and potential consequences.